The Federal Council is submitting the draft of the revised Collective Investment Schemes Ordinance for consultation.

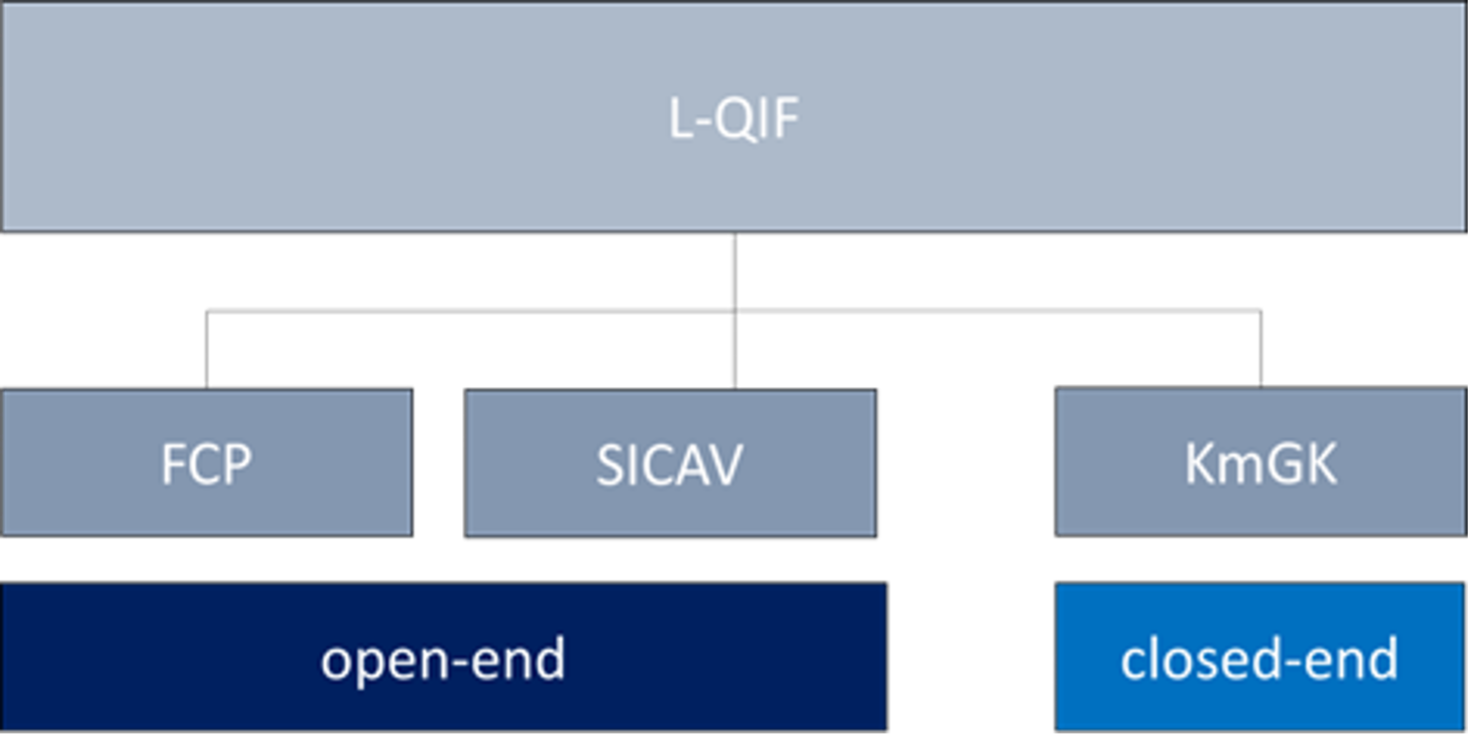

The L-QIF can be set up as a contractual fund, as a SICAV or as a limited partnership for collective investment schemes.

LQIFs can be open or closed and, in the case of open-ended vehicles, can be set up as individual funds or as an umbrella structure consisting of several sub-funds.

Supervision

The L-QIF is not subject to any approval or authorisation requirement by FINMA and is not supervised by FINMA.

Investor base

The L-QIF is open exclusively to qualified investors.

In the case of direct investments in real estate, the L-QIF is available exclusively to “per se” professional clients, with the exception of family offices and clients who have become professional clients on the basis of an opting-out declaration.

Fund documents

The following documents must be prepared for an L-QIF:

Minimum assets

The minimum assets of an L-QIF should amount to CHF 5 million one year after launch.

Fund management company/manager of collective assets

LQIFs are obliged to mandate a fund management company for administration and portfolio management. The delegation of investment decisions – irrespective of the volume of the L-QIF – may only be delegated to a domestic or foreign manager of collective assets (VKV).

Liquidity

In the case of open-ended L-QIFs with assets that are difficult to value or market, the units must generally be redeemed every two years. During the first 5 years after launch, the open-ended L-QIF may remain closed for redemptions. This must be stipulated in the fund documents.

Open-ended L-QIF

In principle, the investment regulations for securities funds, real estate funds and other funds for traditional and alternative investments as well as for limited partnerships for collective investment schemes are not applicable to the L-QIF.

However, all investment regulations must be described in detail in the fund documents:

Closed-ended L-QIF